How Technology can help You grow your Wealth?

- Feb 13, 2020

- 3 min read

Updated: Mar 18, 2024

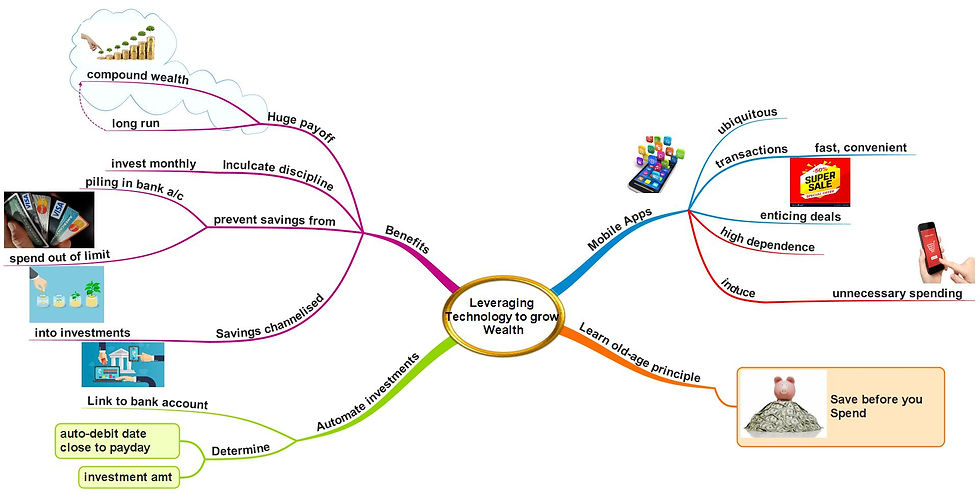

Mobile apps in our smartphones have become a ubiquitous part of our everyday lives. They are fast and convenient. Apps are just a swipe away – Amazon for shopping, Ola/Uber for travel, Zomato for food orders, etc. However, this high dependence on mobile apps is also enticing us to spend more. Add to that, the discount offers and cash back deals are too hard to resist. We aimlessly spend gobs of time scouting for attractive deals and buy that extra jacket or footwear just because there is an attractive discount offer. As automation induces human behaviour to spend money, at many occasions, people end up going overboard. Many would be even oblivious to this tendency.

So how do you save?

If spending has increasingly become technology driven, so has saving and investing. Automating your savings and investment is one powerful tool which can immensely help you grow your wealth and achieve your financial goals. And how you can do this? Let us understand a simple concept first. It is the concept of earn-invest-spend, rather than earn-spend-invest. Follow a simple practical age-old principle –Save before you spend.

As Warren Buffett popularly quoted ‘Do not save what is left after spending, but spend what is left after saving’. So, determine a set amount to be invested immediately after payday. Automate the investments by linking the same to your bank account. Treat the amount to be invested like an expense which will get auto-debited from your bank account in the first week of the month. This will work just like your EPF where a certain portion of your income is deducted by your employer and contributed to your provident fund account at the start of a month.

Benefits of automation:

Channelising savings: Many a times, savings keep piling up in a bank account month after month, earning abysmal returns. This is either spent eventually or converted into a big fixed deposit or randomly invested for any tax saving opportunity. Automation will ensure that your money gets efficiently channelized into investments at the beginning of the month and every month.

Avoid unnecessary spending: Investing first before spending is easier said than done. Automation will ensure that your money gets invested first before you spend it. In this manner, you will not lose sight of your cash flows and go overboard on online spending.

Inculcate discipline: If you were to commit to investing manually on a monthly basis, can you imagine doing it for next 5-10 years? Practically, not a feasible option. You may procrastinate or miss it for spending elsewhere or might even forget. Automation can help to inculcate the necessary discipline to invest on a regular basis for a longer time horizon. It could be a systematic investment plan (SIP) in a mutual fund, recurring deposit, PPF or any other postal deposit scheme, etc. You can also use automation for bank fixed deposits which when linked to your savings account facilitates automatic transfers of a set amount once your savings balance crosses a certain limit.

Imagine how it feels if your money is automatically taken care of every month and is working for you 24/7. It feels wonderful and the payoffs are huge in the long run. Automating your investments is a practical hassle-free tactic of gradually growing your wealth and achieving your financial goals.

Comments